We know from a lot of serious academic research that when government debt reaches about 50% of GDP, GDP starts to be adversely affected. As you go up the rung, at 60% the deleterious effect is greater. At 70%, it’s still greater. When debt-to-GDP exceeds 90%, economies lose about a third of their growth rate against trend. And, unfortunately, we’re already outside the historical range of 107% before the coronavirus hit. And we’re going on up to around 130%…

Keep in mind, both the numerator and the denominator are deteriorating. We’re going to be facing something like 10% or greater decline in nominal GDP. And the two stimulus bills that were passed in the last couple of weeks are worth about $2.7 trillion. That’s equivalent to 13% of last year’s GDP, not this year’s GDP. So…we’re effectively at 120% right now. And soon we’ll be at 125% and then higher. Because keep in mind, there will be a falloff in the personal income-tax collections, corporate-tax collections, and built-in stabilizers, Social Security and unemployment compensation and food stamps and all of the like will have to kick in. And so, we’re going to have a truly astronomic level of debt-to-GDP. And this is going to push up public and private debt to about 400% of GDP. And that means that every dollar of debt will only be generating about 25 cents of GDP growth.

So, this will be a new low in debt productivity for the United States and that’s an indication of diminishing returns…And of course, everybody assumes that larger sums of debt produce bigger gains. They don’t understand that the relationship is nonlinear. They don’t even want to know the concept.

– Dr. Lacy Hunt, Executive Vice President, Hoisington Investment Management Company, 13-D Research, 4/2/20

There will be a vast angle of unpaid debts that cannot be cleared, and—what is different from 2008 and 2009—the model of foreclosures, evictions and repossessions to deal with them is going to be absolutely unacceptable. People sheltering at home without income are in no way responsible for their circumstances and will refuse to accept the terms of those contracts. So the contracts will have to be suspended, and the debts cleared away, or there will be a confrontation on a vast scale…The right model is that of the treatment of inter-allied war debts after World War II: They were canceled, because dealing with the common enemy was a common effort. So, the whole financial system will have to be reset. This is not an ideological point but a practical necessity for reestablishing a functioning economic system.

– James Galbraith, Professor of Government, University of Texas, 4/6/20

In finance, most surprising to me is that despite the trillions the U.S. is adding to our budget deficit and national debt, investors (many foreign) will lend the U.S. a virtually limitless supply of dollars for 0.6% for 10 years.

– Lloyd Blankfein, Former Chief Executive Officer, Goldman Sachs, 4/23/20

I have long time been an advocate for the need for the United States to return to a sustainable path from a fiscal perspective at the federal level. We have not been on such a path for some time which just means that the debt is growing faster than the economy. This is not the time to act on those concerns. This is the time to use the great fiscal power of the United States to do what we can to support the economy and try to get through this with as little damage to the longer run productive capacity of the economy as possible. The time will come, again, and reasonably soon, I think, where we can think about a long-term way to get our fiscal house in order. And we absolutely need to do that. But this is not the time to be, in my personal view, this is not the time to let that concern, which is a very serious concern, but to let that get in the way of us winning this battle.

– Jerome Powell, Chair, Federal Reserve [Permanent FOMC Voter], 4/29/20

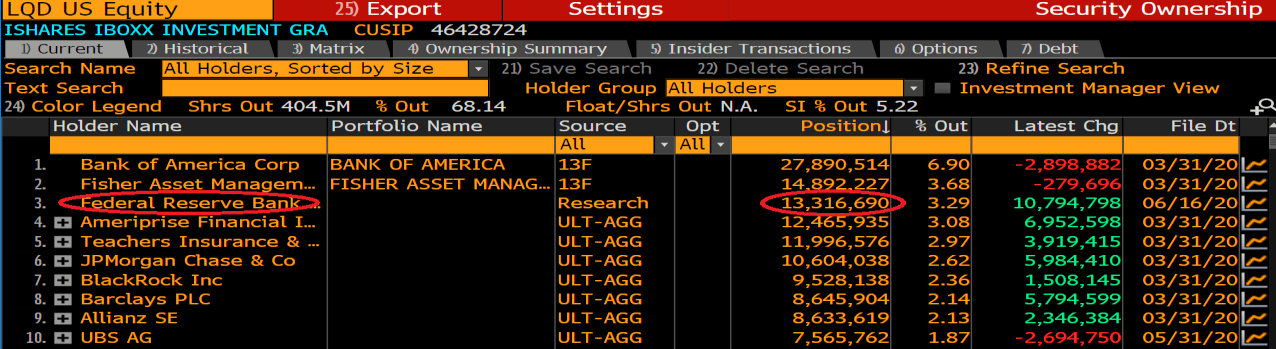

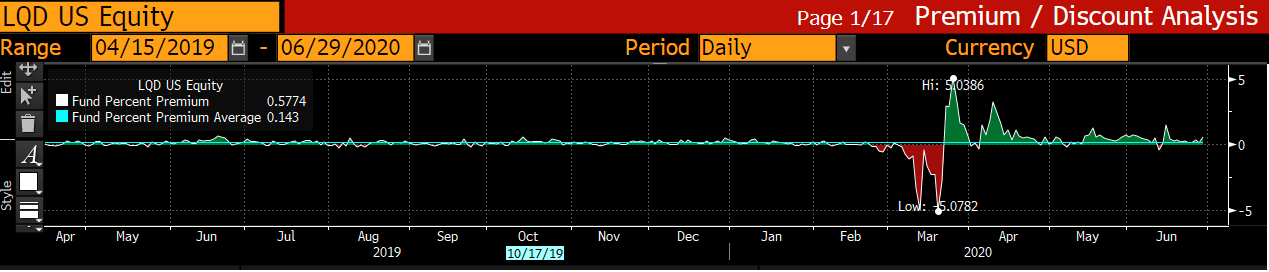

Many companies that would’ve had to come to the Fed have now been able to finance themselves privately since we announced the initial term sheet on these facilities. The ultimate demand for the facilities is quite difficult to predict because there is this ‘announcement effect” that really gets the market functioning again. Of course, we have to follow through, though. And we will follow through to validate that announcement effect.

– Jerome Powell, Chair, Federal Reserve [Permanent FOMC Voter], 4/29/20

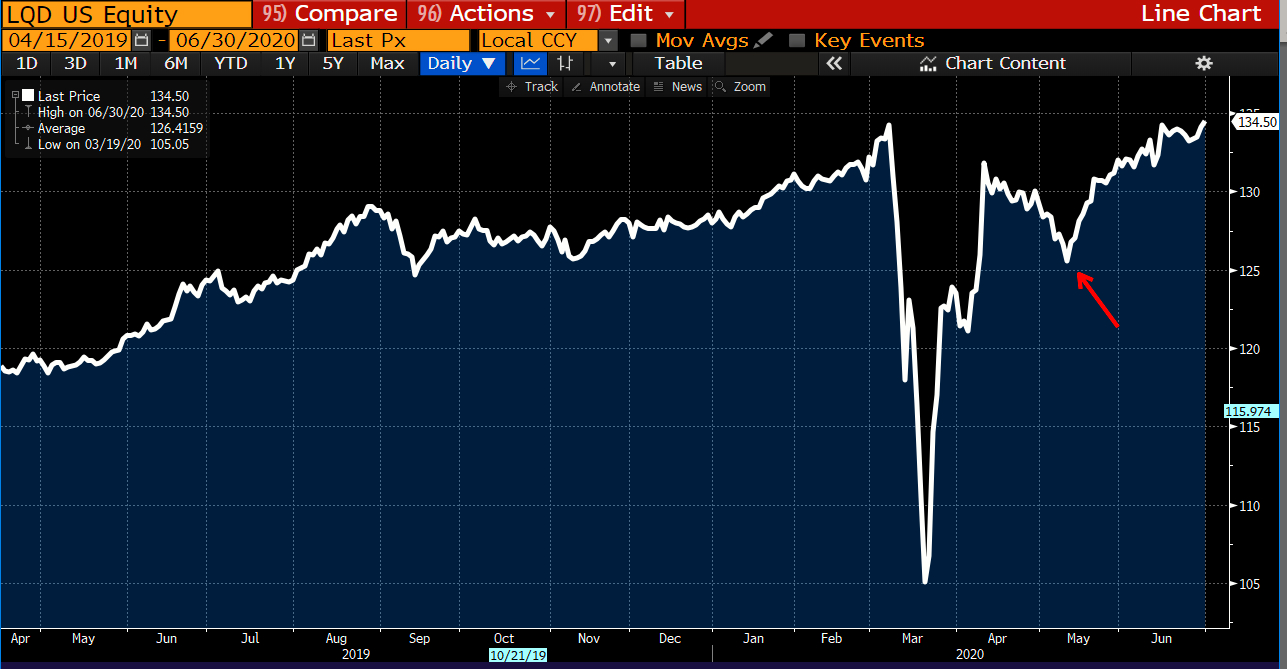

I am told the Fed has not actually bought any Corporate Bonds via the shell company set up to circumvent the restrictions of the Federal Reserve Act of 1913. Must be the most effective jawboning success in Fed history if that is true.

– Jeffrey Gundlach, Chief Executive Officer, DoubleLine Capital, 5/1/20

At its roots, QE is a mechanism of wealth redistribution. Zero rates transfer wealth from savers to borrowers and speculators. Moreover, there are myriad costs associated with central banks nullifying the business cycle. The toll the unfolding crisis will inflict upon minority and low-income families will be horrendous. Federal Reserve policies of unrelenting monetary stimulus and market intervention ensure an especially problematic downturn. The business cycle is absolutely essential to the functioning of capitalistic systems. Policymaker intolerance for even mild market and economic corrections promotes cumulative excess and distortions that will culminate in extraordinarily deep and painful busts.

– Doug Noland, Editor, Credit Bubble Bulletin, 5/2/20

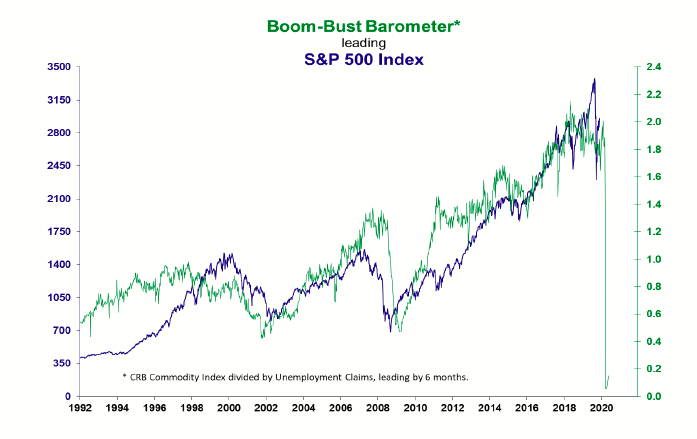

Too many people are anticipating a kind of V-like recovery. We’re all going to be permanently scarred by having lived through this. How soon will anybody get on an airplane? How soon will anybody stay in a hotel? How soon will anyone go to a mall? The fact that these places may be open doesn’t necessarily mean that they’ll be doing busines… Bankruptcies are what you need to clear markets and what you need to end recessions and dips. The fact that there’s a lot more distressed players today will help clear the market, but it also means that there aren’t anywhere near as many opportunities as there were in the past.

– Sam Zell, Chairman, Equity Group Investments, 5/5/20

The bull market’s over and we’re in a bear market. We’re going to be in bear market territory easily for a good nine months, with no return of the bull market anytime soon. This market’s been highly concentrated in a handful of so-called ‘stay at home’ names…This market is divorced from reality, there’s such a strong bid to this market—particularly in the overnight futures trading—it just doesn’t make any sense.

– Chris Ailman, Chief Investment Officer, California State Teachers’ Retirement System, 5/5/20

We’re living through the most severe contraction in [economic activity] and surge in unemployment that we’ve seen in our lifetimes. We’re in a period of some very, very, very hard and difficult data that we’ve just not seen for the economy in our lifetimes, that’s for sure. But a third quarter rebound is one possibility. That is personally my baseline forecast…Realistically, it’s going to take some time for the labor market to recover from this shock. I do think the recovery can commence in the second half of this year…It’s important to make sure the rebound is as robust as possible, but can’t minimize that we are in recession, a global recession.

– Richard Clarida, Vice Chairman, Federal Reserve, 5/5/20

We manage the Global financial system, which transacts in the currency we print. We control the oceans to ensure the safety of the Global supply chain. Our legal system is an aspiration, and our military keeps hot spots localized to mitigate nuclear annihilation. So, WTF happened? The Chinese lied—of course they did! But that’s why we have some version of SkyNet watching. And let’s not forget Google, Facebook and Apple, that make The Matrix look benevolent. Whatever. Since the Government will not think two moves ahead, we shall be forced to do it ourselves; thus, let’s consider the next Black Swan.

– Harley Bassman, Creator, Merrill Lynch RateLab, Publisher, Convexity Maven, 5/5/20

Deceased and incarcerated individuals do not qualify to receive Economic Impact Payments. See FAQ #41 to learn how to return an inadvertent payment @ https://www.irs.gov/coronavirus/economic-impact-payment-information-center

– U.S. Treasury Department “Tweet” @ USTreasury, 11:08 AM, 5/6/20

The shutdown can’t go on forever because if it does, deep into the second half, then I think you risk getting into a financial crisis or even a depression scenario. And if you get into that I think even health outcomes would be way worse…The jobs report will be one of the worst ever…So far so good. I think our liquidity measures are looking good.

– James Bullard, President, Federal Reserve Bank of St. Louis [2022 FOMC Voter], 5/6/20

No one I talk to is looking at a V-shaped recovery, they really think this will be gradual and it will take time to build confidence back up for both workers and consumers.

– Mary Daly, President, Federal Reserve Bank of San Francisco [2021 FOMC Voter], 5/7/20

I think for the country the short-term outlook is really bleak. The best-case scenario would be a quick bounce-back, but it’s hard for me to see that until we get some type of technological breakthrough in a vaccine or a therapy. We should plan for a much more gradual recovery.

– Neel Kashkari, President, Federal Reserve Bank of Minneapolis [2020 FOMC Voter], 5/7/20

One of the roles of economists like myself that are in academia…is to really try to push us into a much better place. I really believe that fifty years from now people are going to look back – economists are going to look back – as the existence of cash much like we look back at the gold standard. We look back at the gold standard as a period which really hamstrung monetary policy and created huge amounts of unemployment as a result during the Great Depression. People are going to look back at the existence of cash and the zero lower bound – the inability to go much below zero with interest rates – in the same way, hamstringing the ability of central banks to provide sufficient support to the economy – and thereby creating excessive unemployment and robbing people of their jobs.

– Naryana Kocherlakota, Former President, Federal Bank of Minneapolis, 5/7/20

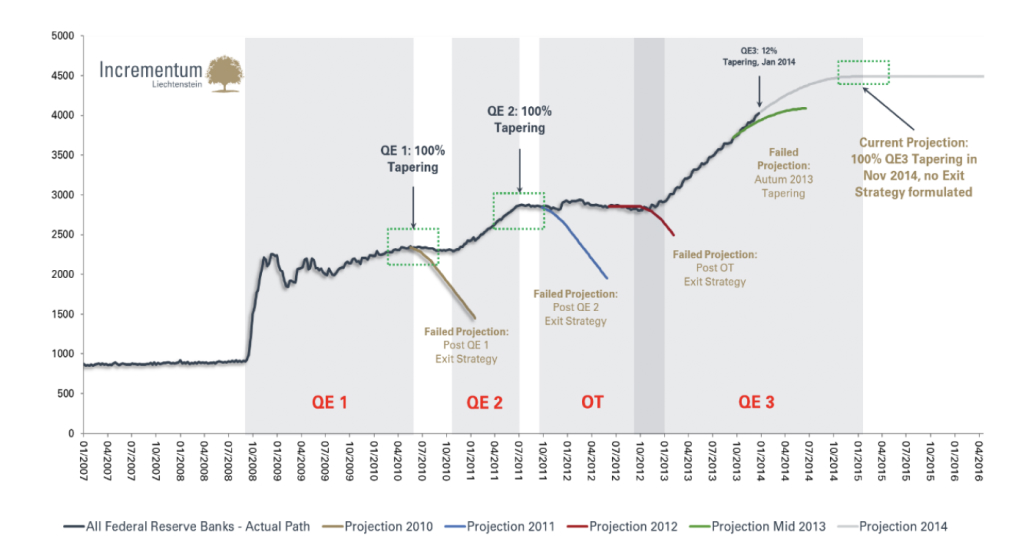

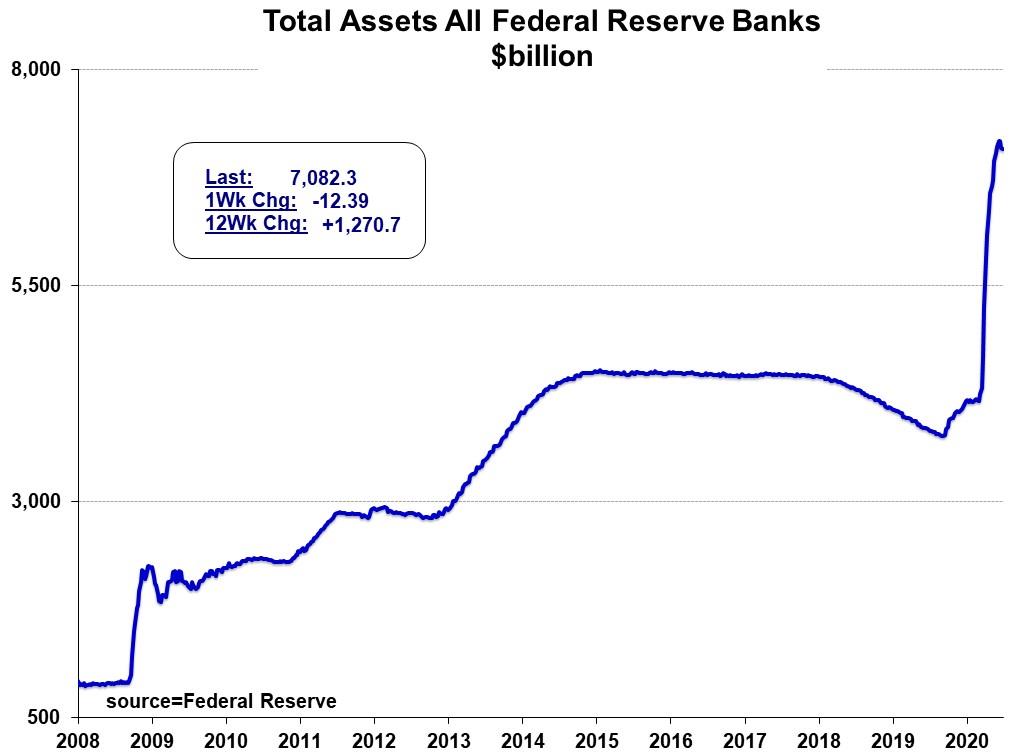

COVID-19 is a one-of-a-kind virus that has triggered a one-of-a-kind policy response globally. The depth and magnitude of the economic drop-off took modern monetary theory—or the direct monetization of massive fiscal spending—from the theoretical to practice without any debate. It has happened globally with such speed that even a market veteran like myself was left speechless. Just since February, a global total of $3.9 trillion (6.6% of global GDP) has been magically created through quantitative easing. We are witnessing the Great Monetary Inflation (GMI)—an unprecedented expansion of every form of money unlike anything the developed world has ever seen.

The best profit-maximizing strategy is to own the fastest horse. If I am forced to forecast, my bet is it will be Bitcoin…Bitcoin reminds me of gold when I first got into the business in 1976.

Speaking of gold, in a low-carry world, gold remains a very attractive hedge against the Great Monetary Inflation and hedges against other risks clouding the outlook, including a renewed flare up in the China-US relationship where financial sanctions could eventually be used in a brute-force decoupling. How far can gold rally from its current price? A simple metric based on the ratio of the value of gold above ground to global M1 suggests gold could rally to 2,400 before it reaches valuations consistent with the lowest of the last three peaks in this valuation metric and 6,700 if we went back to the 1980 extremes.

– Paul Tudor Jones, Chief Executive Officer, Tudor Investment Corporation, 5/7/20

The states and the local governments are definitely going to need more help, and I think the federal government should be thinking about the best way to do that…I think there’s a possibility of opening up in the second half of the year, but it has to be done in a very careful way to avoid having to go backwards, because that would be a devastating outcome.

– Loretta Mester, President, Federal Reserve Bank of Cleveland [2020 FOMC Voter], 5/8/20

I mean the worst is yet to come on the job front, unfortunately…What I’ve learned in the last few months, unfortunately, this is more likely to be a slow, more gradual recovery…It’s really around 23%-24% of people who are out of work today, and if this is a gradual recovery the way I think its going to be, those folks are going to need more help…If this is going to go on for a long period of time—I think its going to go on in some phases for a year or two—I think Congress is going to need to continue to give assistance to workers who’ve lost their jobs.

– Neel Kashkari, President, Federal Reserve Bank of Minneapolis [2020 FOMC Voter], 5/10/20

Since there is a robust Fed liquidity backstop, and we do not know the depth or duration of the current economic downturn, spending any time looking at economic data releases or focusing on corporate earnings is a colossal waste of time. For economic data, the signal-to-noise ratio is essentially zero, and for corporate earnings, N-T results are meaningless with regard to L-T earnings potential. The item to focus on is the Fed and its direct support for the financial and non-financial IG corporate sectors.

– David Zervos; Chief Market Strategist, Jefferies LLC, 5/11/20

You will get business failures on a grand scale and you will be taking risks that you would go into depression…[Q2 GDP] will be a staggering figure and way beyond anything experienced in the post-war era in the U.S. We cannot hit the pause button for very long in major economies around the world, certainly not in the U.S. There’s a 90-day limit or shelf life on this policy, maybe 120-day shelf life.

– James Bullard, President, Federal Reserve Bank of St. Louis [2022 FOMC Voter], 5/12/20

Our outreach at the Cleveland Fed is painting a very painful picture. Since mid-March, we have watched confidence among regional businesses and households drop from week to week as the negative effects of the virus have risen. Regional firms are taking defensive positions, pulling back from risk taking, conserving cash, putting capital expenditures on hold, and drawing on their credit lines. At the start of the shutdown, many told us that they intended to keep their employees on their payrolls, but over time, an increasing number have felt the need to lay off or furlough workers. The Cleveland Fed’s national survey of consumers indicates that most respondents initially thought the virus outbreak would last less than six months. More now believe it will last one year, and a growing number think it could last two years.

– Loretta Mester, President, President Federal Reserve Bank of Cleveland [2020 FOMC Voter], 5/12/20

The consensus out there seems to be: ‘Don’t worry, the Fed has your back.’ There’s only one problem with that: our analysis says it’s not true…I pray I’m wrong on this, but I just think that the V-out is a fantasy…[The CARES Act] was basically a combination of transfer payments to individuals, basically paying them more not to work than to work. And in addition to that, it was a bunch of payments to zombie companies to keep them alive.

– Stanley Druckenmiller, Investor, 5/12/20

The committee’s view on negative rates really has not changed. This is not something that we’re looking at. I know that there are fans of the policy, but for now it’s not something that we’re considering. We think we have a good toolkit, and that’s the one we’ll be using.

– Jerome Powell, Chair, Federal Reserve [Permanent FOMC Voter], 5/13/20

“The scope and speed of this downturn are without modern precedent, significantly worse than any recession since World War II. We are seeing a severe decline in economic activity and in employment, and already the job gains of the past decade have been erased. Since the pandemic arrived in force just two months ago, more than 20 million people have lost their jobs. A Fed survey being released tomorrow reflects findings similar to many others: Among people who were working in February, almost 40 percent of those in households making less than $40,000 a year had lost a job in

March. This reversal of economic fortune has caused a level of pain that is hard to capture in words, as lives are upended amid great uncertainty about the future.

The record shows that deeper and longer recessions can leave behind lasting damage to the productive capacity of the economy. Avoidable household and business insolvencies can weigh on growth for years to come. Long stretches of unemployment can damage or end workers’ careers as their skills lose value and professional networks dry up and leave families in greater debt. The loss of thousands of small- and medium-sized businesses across the country would destroy the life’s work and family legacy of many business and community leaders and limit the strength of the recovery when it comes. These businesses are a principal source of job creation—something we will sorely need as people seek to return to work. A prolonged recession and weak recovery could also discourage business investment and expansion, further limiting the resurgence of jobs as well as the growth of capital stock and the pace of technological advancement. The result could be an extended period of low productivity growth and stagnant incomes.”

– Jerome Powell, Chair, Federal Reserve [Permanent FOMC Voter], 5/13/20

I’m 77 years old and I’ve never seen this level of uncertainty. This cycle is different than the other seven bear market cycles I lived through because this is the only one where we had a broad scale shutdown of the economy, which I view as a mistake.

– Leon Cooperman, Chief Executive Officer, Omega Advisors, 5/14/20

Can the Fed keep it up forever? Those of us in the markets believe that stocks and bonds are selling at prices they wouldn’t sell at if the Fed were not the dominant force. So if the Fed were to recede, we would all take over as buyers, but I don’t think at these levels…There are large, highly levered companies and investment vehicles that the government and Fed rescue program is not likely to reach and take care of…And in theory, if they bought aggressively, they could make all the markets rise. Now everyone would know that that’s a Potemkin market, a fake, and the minute they stopped things would collapse.

– Howard Marks, Co-Chairman, Oaktree Capital Group, 5/18/20

We face two fundamental questions. First, how strong and how long will the underlying deflationary forces that need offsetting last? Second, how much is going to be spent on relief and where will all the money be coming from (i.e. borrowed or printed)? The US borrowing requirement is $3trn in Q2 alone and $4.5trn for this fiscal year, though the Democrats have already unveiled a further $3trn coronavirus relief package of their own. It is politicians, not the virus, that are responsible for the sudden economic stop and their solution, throwing huge amounts of money that doesn’t yet exist at anyone who might be suffering from their actions, betrays a complete lack of monetary understanding. Even Lenin was reputed (by Keynes, who probably made it up) to have said that ‘the best way to destroy the capitalist system is to debauch the currency.’ Now we get to find out if he was right.

– James Ferguson, Principal, MacroStrategy Partnership, 5/19/20

My guess is we are going to need to do more. But my guess is also you’re going to need more fiscal action, whether it’s aid to governments or other fiscal action as we go through this. The problem is that we’re going to have an unemployment rate that peaks at around 20%, which we’re going to reach very soon. We’re going to end the year with an unemployment rate as high as 10%, and we’re going to need to grind that down, and it’s probably going to take more fiscal action to help grind that down.

– Robert Kaplan, President, Federal Reserve Bank of Dallas [2020 FOMC Voter], 5/20/20

I don’t believe it’s going to be enough just to go back to where the economy was. We’re going to need to stimulate the economy, and government has a role to play in that. It always has.

– Andrew Cuomo, Governor, New York, 5/24/20

JP Morgan is prepared for a scenario where recovery is slower…The Fed’s liquidity, bringing out the bazooka, is propping up stock prices.

– Jamie Dimon, Chief Executive Officer, JP Morgan, 5/26/20

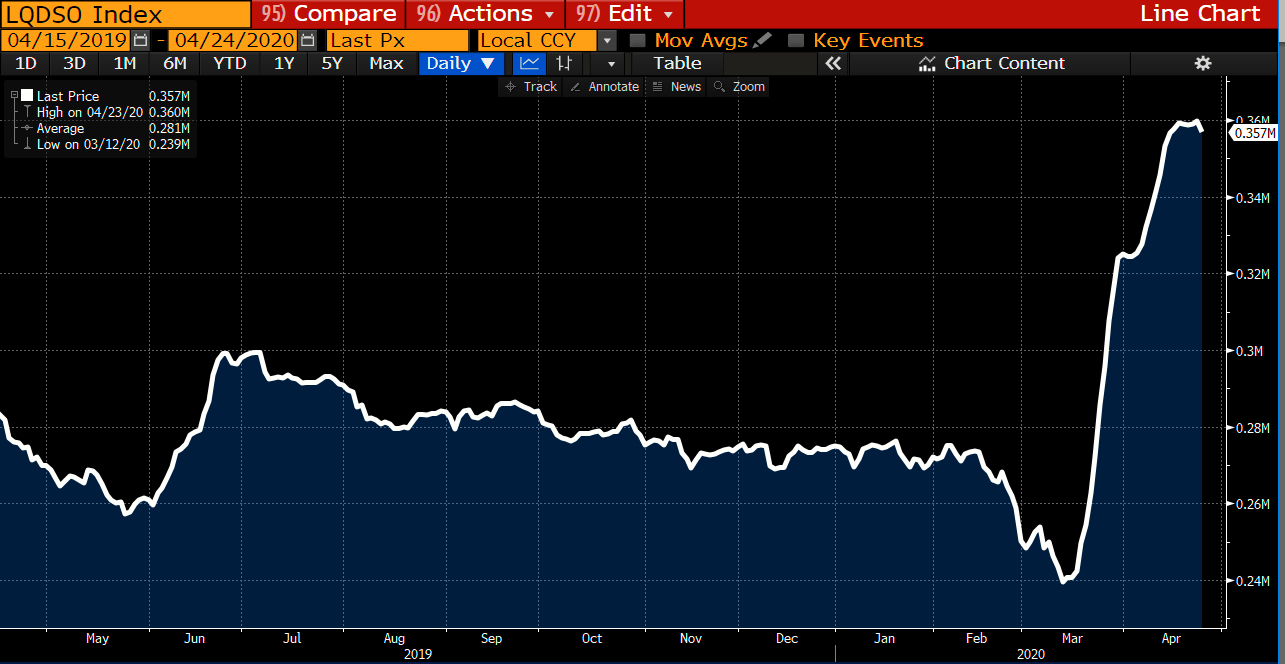

That said, the Fed’s actions have a cost because they tend to encourage risky behavior that we want to avoid — a problem known as moral hazard. Not all of those who got help were blameless. Consider, for example, the Fed’s enormous purchases of Treasuries as trading began to seize up. It was, in fact, a backdoor bailout of highly leveraged hedge funds that were caught in an untenable trade of being long cash Treasuries and short Treasury futures. When volatility was low, these positions could be leveraged up to generate attractive returns. But when the pandemic hit and volatility soared and those trades lost value, margin lenders who financed the positions asked for more equity. This led to fire sales, with many sellers and few buyers. The result was a climb in Treasury yields, a widening in bid-offer spreads and a sharp drop in liquidity in what is normally the most liquid market in the world.

The Fed decided that the risk of a dysfunctional Treasury market was bigger than the downside of bailing out the leveraged hedge funds. Although the Fed helped stabilize the Treasury market, it also made it possible for the hedge funds to avoid bearing the full costs of their risky decisions. The story isn’t much different in the mortgage-debt market. As volatility soared, real-estate investment trusts that invest in mortgage-backed securities were forced sellers as they struggled to meet margin calls. Again, the Fed purchases helped limit their losses.

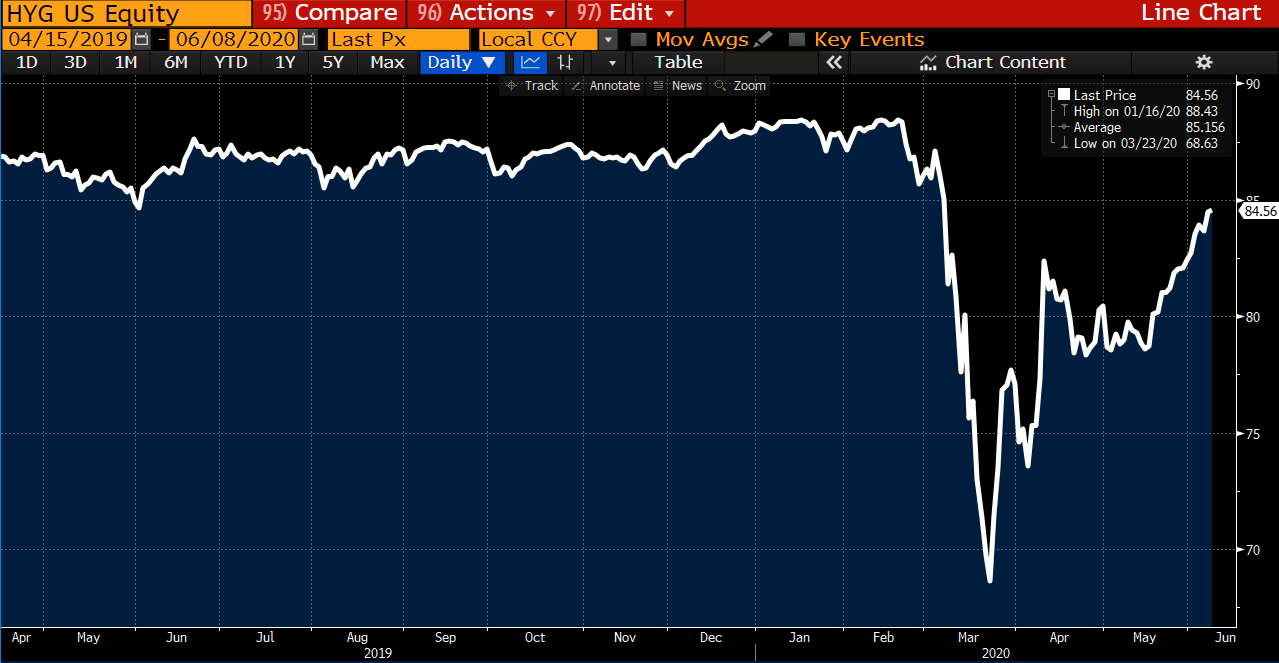

Heavily indebted corporation also got a helping hand. This is significant because many corporations took on lots of debt by choice. The Fed’s response was to set up corporate bond facilities, limiting the fall in lower-rated corporate debt prices and keeping these markets accessible for companies that needed to raise funds. These actions also protected investors in high-yield mutual-bond funds. Had the funds been forced to sell amid plunging prices to meet large redemptions, this could have set off a chain reaction in which falling prices begat more sales. Both the asset managers and the retail investors who bought shares in these junk-bond funds escaped bearing the cost of their actions.

– William Dudley, Former President, Federal Reserve Bank of New York, 6/5/20

Even after three years, my projected recovery places us below where the economy would have been had the virus not occurred. The economic impact has been catastrophic for an extraordinarily large number of people and businesses, and sadly, the cost has fallen most heavily on some of our most vulnerable populations…Risks are weighted to the downside. Other forecasts with more severe effects on economic activity are almost equally as plausible in my view. More [monetary policy support] may be necessary.

– Charles Evans, President, Federal Reserve Bank of Chicago [2021 FOMC Voter], 6/24/20

The equity market does seem to be a little ahead of my view of the future earnings performance of businesses. If I’m right about that you’ll see a rebalancing of that over time.

– David Solomon, Chief Executive Officer, Goldman Sachs Group Inc., 6/24/20

Many people living in the West are dissatisfied with their own society. They despise it or accuse it of no longer being up to the level of maturity by mankind. And this causes many to sway toward socialism, which is a false and dangerous current.

– Aleksandr Solzhenitsyn, Commencement Address, Harvard University, 6/8/78